Doosan Bobcat signs 10-year lease at Swords Business Campus

Doosan Bobcat, the US engineering and construction machinery manufacturer, has committed to a new 10-year lease on premises at Swords Business Campus in north Dublin.

It is understood that the US company has agreed to pay about €16 per sq ft for 10,000sq ft of office space at the development – a fraction of the €50 plus per sq ft it would pay in Dublin’s central business district.

While Doosan Bobcat had been based in the Swords business park already, it exercised the break option on its previous offices and had been looking for new space in north Dublin. Having explored a number of options in the area, the company decided to relocate to a new building at Swords Business Campus.

“Our business recently decided to remain at the business campus for the next number of years as we appreciate its cost competitiveness, its location and most importantly, our employees are very happy working here,” said David Guerra, human resources governance director for EMEA Doosan Bobcat. “With our employees commuting from Meath, Louth and the greater Dublin area, the location of the Swords business campus is ideal for our business.”

Conor Fitzpatrick of JLL’s office division, which is handling the lettings for the business park along with TWM, said availability within the campus has “steadily decreased” over the last couple of years.

“The owners have carried out significant works throughout the park, which has seen the improvement of both the standard of office space and the flexibility of offering for prospective tenants,” he said.

Both JLL and TWM say they are seeing strong interest for the remainder of the space within the park, with an emphasis among prospective occupiers for “ready-to-go” space which is capable of being adapted to bespoke requirements.

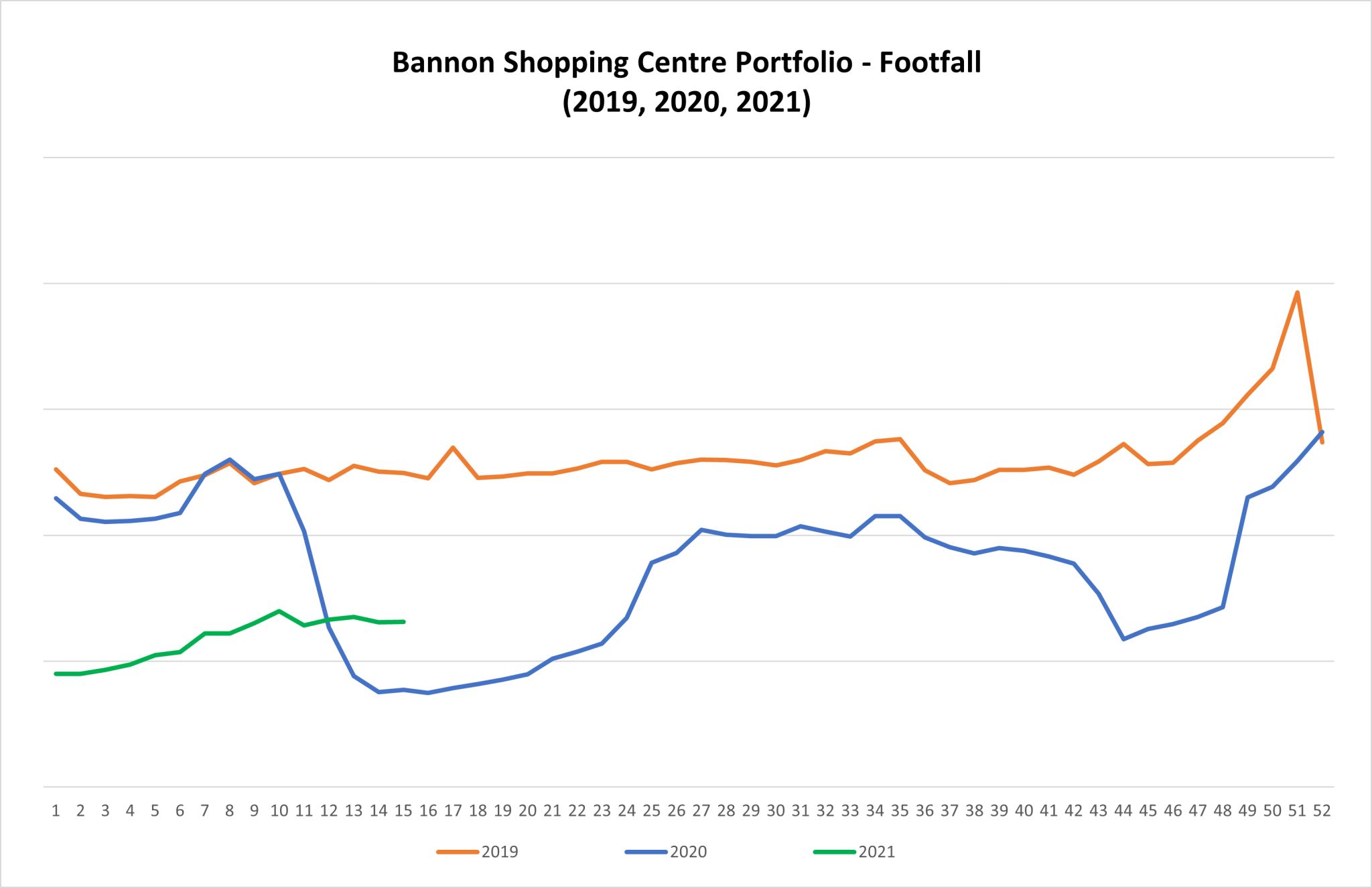

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in